After years of development, China's polyvinyl alcohol industry has become the focus of domestic and foreign markets. As of the first half of 2023, the total production capacity of polyvinyl alcohol in mainland China has reached 1.096 million tons (excluding Taiwan), and the actual output is approximately 400,000 tons, showing a large production scale and market share. The concentration of production capacity is high, and some large enterprises such as Wanwei High-tech and Sinopec have occupied a high market share by virtue of their technology, capital and market advantages.

In international trade, China's polyvinyl alcohol industry occupies an important position, mainly exporting. According to data from the General Administration of Customs of China, my country's polyvinyl alcohol exports will reach 195,000 tons in 2022, a year-on-year increase of approximately 15.9%, showing the strong competitiveness of my country's PVA products in the international market. In addition, although import volume has declined, there is still a certain market demand, which may be related to the domestic market demand for high-quality, special PVA products.

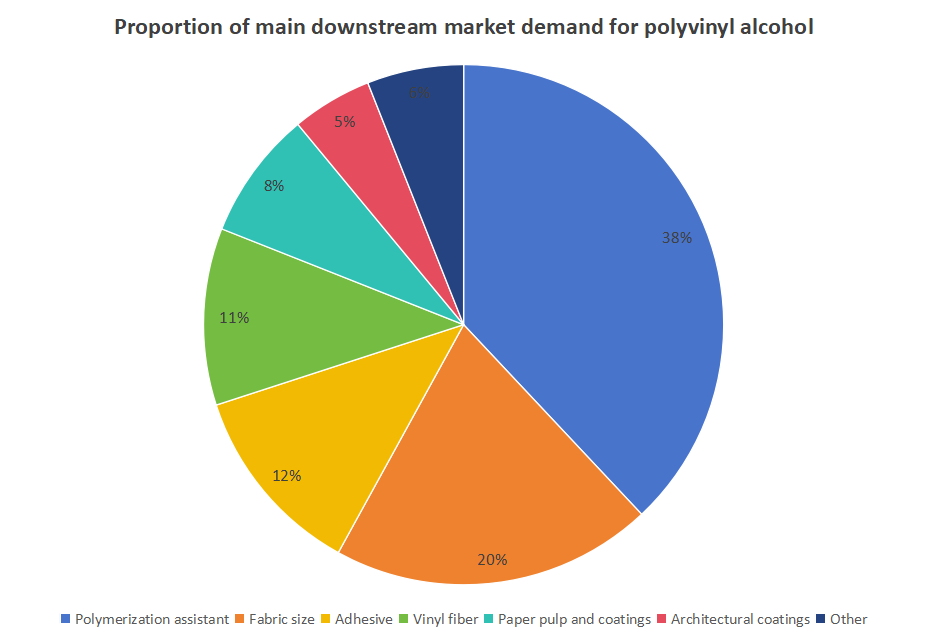

The market demand for polyvinyl alcohol in China continues to grow, mainly benefiting from the continuous expansion of downstream application fields. Polymerization aids, fabric sizing and adhesives are the main downstream consumer markets for polyvinyl alcohol. According to the "In-depth Research and Development Strategy Forecast Report on China's Polyvinyl Alcohol Industry from 2024 to 2029" released by the China Industrial Research Institute, polymerization aids account for about 38% of the PVA consumption structure, fabric slurries account for about 20%, and adhesives account for about Accounting for 12%, vinylon fiber accounts for about 11%, paper pulp and coating account for about 8%, and architectural coatings account for about 5%. Changes in demand in these application fields directly affect the market demand and price fluctuations of polyvinyl alcohol.

In addition, the demand for high value-added PVA products in new industries such as photovoltaics, optoelectronics, and medicine continues to increase, and the industry will enter a healthy development stage of transformation and upgrading. High value-added PVA products such as PVB film, PVA water-soluble film, etc. will have greater market potential.

The supply capacity of China's polyvinyl alcohol industry continues to improve, mainly due to the expansion of production capacity and technological innovation. In terms of production capacity layout, domestic PVA companies are mainly concentrated in areas with rich resources or large market potential such as Shanxi, Shaanxi, Liaoning, and Xinjiang, forming a regional competition pattern. At the same time, as environmental protection requirements increase and market competition intensifies, companies need to increase investment in technology research and development and innovation, improve product quality and reduce costs to gain competitive advantages.

Website: www.elephchem.com

Whatsapp: (+)86 13851435272

E-mail: admin@elephchem.com

ElephChem Holding Limited, professional market expert in Polyvinyl Alcohol(PVA) and Vinyl Acetate–ethylene Copolymer Emulsion(VAE) with strong recognition and excellent plant facilities of international standards.